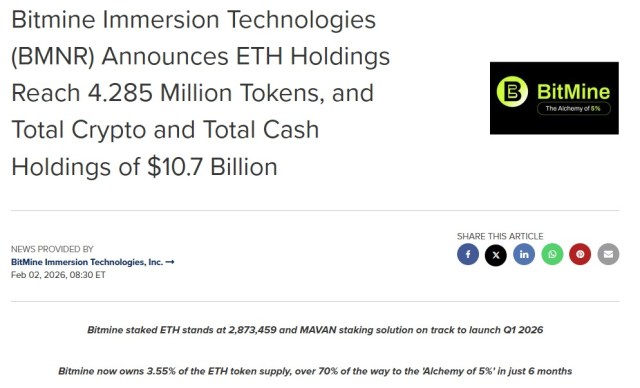

Institutional capital isn’t just tiptoeing around Ethereum anymore; it’s stomping in. BitMine, a heavyweight in digital asset mining, has officially expanded its Ether treasury to a massive $10.7B following its latest strategic acquisition.

This purchase marks a pivotal shift in market structure, moving beyond simple speculation toward genuine balance sheet fortification.

The timing is critical. On-chain metrics are already flashing signs of a deepening supply squeeze as exchange reserves hit multi-year lows. BitMine’s aggressive buying acts as a volatility dampener for the second-largest cryptocurrency.

That matters. Large-scale accumulation usually precedes a reduction in liquidity, where price discovery becomes hypersensitive to marginal demand. When entities like BitMine lock billions in cold storage, they effectively remove that supply from circulation, theoretically establishing a higher price floor.

While institutions play the safe long game with blue-chip assets, retail traders are signaling a different kind of appetite. The stability provided by these institutional floors often emboldens high-frequency traders to seek alpha further out on the risk curve. This rotation of capital, from safety to speculation, is fueling a surge in the meme token sector.

That’s where Maxi Doge ($MAXI) has emerged as a focal point for traders seeking high-leverage exposure.

Buy your $MAXI here.

Maxi Doge Brings Gym-Bro Intensity to Ethereum’s Meme Ecosystem

While the broader market watches BitMine stabilize the macro environment, the meme token niche is rewarding projects that bring utility to the culture of volatility. Maxi Doge has captured this sentiment by positioning itself as the ‘Leverage King’ of the ERC-20 space.

Distancing itself from the passive ‘hold and hope’ strategy of earlier dog coins (which often fail to deliver), the project embodies the aggressive mentality of 1000x leverage trading. The brand identity centers on ‘never skipping leg day’ and the perpetual grind of the bull market.

This narrative seems to be hitting home with sophisticated capital. On-chain data from Etherscan shows two whale wallets accumulated $503K in recent transactions, a signal that smart money is hunting for outsized returns beyond standard ETH beta.

The appeal lies in the ecosystem design, which essentially gamifies the trading experience. By introducing holder-only competitions and a ‘Maxi Fund’ treasury, the project aligns community incentives with price performance.

It’s a pivot from memes as passive images to memes as active financial sports. The market data implies that traders are increasingly favoring tokens that reflect their own aggressive strategies, ‘lift, trade, repeat’, rather than those relying solely on cute aesthetics.

Explore the Maxi Doge ecosystem.

Presale Data Points to Strong Momentum for $MAXI Staking Model

The financial structuring of Maxi Doge focuses on liquidity retention through dynamic staking rewards. Unlike projects that flood the market with tokens immediately, the smart contract governs supply through a 5% staking allocation pool, offering daily automatic distribution for up to one year.

This mechanism encourages holders to lock assets, theoretically reducing sell pressure while earning yield. It’s a strategy that mirrors the institutional ‘hodl’ mentality, just with significantly higher risk-reward ratios.

According to the official presale page, Maxi Doge has raised over $4.5M, validating strong early interest. With tokens currently priced at $0.0002802, the valuation offers an entry point that stands in stark contrast to the multi-billion dollar market caps of established meme coins.

For retail investors, the math is simple: catching a 10x or 100x return is often more probable from a sub-penny price point than from assets already saturated with capital.

Current capital inflows suggest the market is hunting for an Ethereum-based contender to challenge the dominance of Solana memes. By using the security of the Ethereum Proof-of-Stake network while adopting the viral ‘gym bro’ humor that dominates crypto Twitter, the project creates a dual-threat value proposition.

It offers the technical reliability of ERC-20 with the viral velocity of a breakout meme, a counterbalance to the slow, steady accumulation seen in BitMine’s strategy.

Learn more about the Maxi Doge presale.

The content provided in this article is for informational purposes only and does not constitute financial advice. Cryptocurrency markets are highly volatile, and meme tokens like $MAXI carry significant risk. Investors should conduct their own due diligence and never invest more than they can afford to lose.